SS ? Easy fix. Medicare ? Harder to fix but doable. The Govt budget ? Read the above. Yet , some idiots persist in a "deficit crisis".

Deficit = not a problem

-

Paladin

- SEOP

- Posts: 4304

- Joined: Thu Nov 17, 2011 3:13 pm

- Location: Warren-Youngstown, Ohio metro area

Deficit = not a problem

I must admit I get a chuckle every time I see a TeaBagger who starts another thread on the "deficit problem". First, there isn't a problem. If there was, the markets would have forced up interest rates in the bond markets and the stock market would have crashed. HELLO ? Interest rates remain at historical lows and the stock market just DOUBLED Under the 4 years of Obama, recovering from the disaster of debt that the Rs and W. created with their stupid policies, wars and tax cuts. Second, Nobel Prize award winning economist Paul Krugman has been correct in calling the Rs out for manufacturing another "crisis" were none exists. In fact, the debt as a % of GDP has DECLINED during the Obama administration years, as he points out. Third, ALL economists no matter their political bend recognize that as the economy recovers , it creates more tax income further driving down the debt. While the recovery is slow, it is recovering from all the mistakes the Rs created. The recovery continues with positive job creation month after month and has since Obama started his policies. And finally, taxes are still at historic lows and could and will be raised bring back for more revenue. It all combines to be another BS argument from the Teabaggers. No one who has a serious academic mind about the debt is worried, yet we have idiots trying to sell another "crisis" where none exists.

SS ? Easy fix. Medicare ? Harder to fix but doable. The Govt budget ? Read the above. Yet , some idiots persist in a "deficit crisis".

SS ? Easy fix. Medicare ? Harder to fix but doable. The Govt budget ? Read the above. Yet , some idiots persist in a "deficit crisis".

Re: Deficit = not a problem

Most of them just complain because Mr. O won again. They will tell you different, that is because they just do not know their own problem.

-

Kentucky Trojan

- SE

- Posts: 2183

- Joined: Sat Jul 10, 2010 4:52 pm

Re: Deficit = not a problem

I am one of the few people on this website who can prove you wrong, paladin.Paladin wrote:I must admit I get a chuckle every time I see a TeaBagger who starts another thread on the "deficit problem". First, there isn't a problem. If there was, the markets would have forced up interest rates in the bond markets and the stock market would have crashed. HELLO ? Interest rates remain at historical lows and the stock market just DOUBLED Under the 4 years of Obama, recovering from the disaster of debt that the Rs and W. created with their stupid policies, wars and tax cuts. Second, Nobel Prize award winning economist Paul Krugman has been correct in calling the Rs out for manufacturing another "crisis" were none exists. In fact, the debt as a % of GDP has DECLINED during the Obama administration years, as he points out. Third, ALL economists no matter their political bend recognize that as the economy recovers , it creates more tax income further driving down the debt. While the recovery is slow, it is recovering from all the mistakes the Rs created. The recovery continues with positive job creation month after month and has since Obama started his policies. And finally, taxes are still at historic lows and could and will be raised bring back for more revenue. It all combines to be another BS argument from the Teabaggers. No one who has a serious academic mind about the debt is worried, yet we have idiots trying to sell another "crisis" where none exists.

SS ? Easy fix. Medicare ? Harder to fix but doable. The Govt budget ? Read the above. Yet , some idiots persist in a "deficit crisis".

First of all...I am not a teabagger...I have been both a democrat and a republican in my lifetime. I am currently a republican and I consider myself a fiscal conservative and a somewhat social moderate with leanings toward the conservative side. Nonetheless, my expertise is in fiscal policy.

The deficits have not forced interest rates up and the stock market have not bottomed because there is too much money out there that has to be placed somewhere. The old adage that interest rates have to rise when deficits began does not work in the era of trillion dollar deficits. Any president could make an economy out of it given the huge deficits that exist. Just look at Reagan and the 1980's. Look how good the economy was then. I am sure that you will ask about Clinton in the 1990's since the budget was balanced and we had a sailing economy into the year 2000. This was a booming economy since capital gain taxes helped increase the revenue against the lessening expenses in the late 1990's.

The stock markets have not crashed...yet......however, we are still in the midst of a secular bear market. This secular bear market will not end until nobody wants in the market any longer. My prediction (and others as well) is that the markets will begin to tumble soon and hit rock bottom between 2016 and 2018.

BTW, looks like another secular bear market top to me.

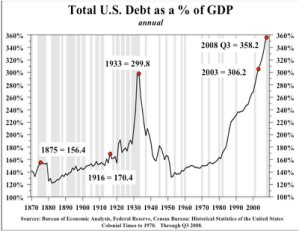

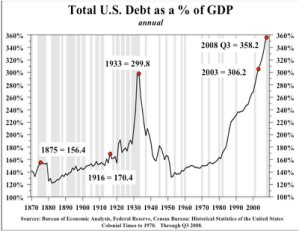

Let's move on to debt as a % of GDP....

It has declined....back to 2007 levels. It is also starting to level out as shown by the chart.

http://www.economagic.com/em-cgi/data.e ... creditdebt

More name calling, paladin? Calling people idiots instead of attacking the issues. For shame from such an intelligent person such as yourself. The truth is that after depressions there is only one way for the debt-to-gdp ratio to go...and that is down.

Revenue does increase as the economy improves. However, these deficits and their corresponding debts will continue to be a noose around our neck until we reduce the deficits and ultimately eliminate the debt.

-

Kentucky Trojan

- SE

- Posts: 2183

- Joined: Sat Jul 10, 2010 4:52 pm

Re: Deficit = not a problem

Notice the Debt to GDP ratio around the Great Depression and look where we are now...

If we don't fix the debt problem now, then this chart will begin its upward movement again.

If we don't fix the debt problem now, then this chart will begin its upward movement again.

- dazed&confused

- SEOPS HO

- Posts: 9287

- Joined: Thu Jul 17, 2008 11:39 am

- Location: Those who do not remember the past are doomed to repeat it

Re: Deficit = not a problem

And yet, a gamechanger is on the horizon....

http://www.nbcnews.com/business/economy ... -1C8344034

Patti Domm , CNBC.com

US is on fast-track to energy independence, report suggests

U.S. oil and gas production is evolving so rapidly — and demand is dropping so quickly — that in just five years the U.S. could no longer need to buy oil from any source but Canada, according to Citigroup's global head of commodities research.

Citigroup's Edward Morse, in a new report, projects a dramatic reshaping of the global energy industry, where the U.S., in a matter of years, becomes an exporter of energy, instead of one of the biggest importers.

The shift could sharply reduce the price of oil, and therefore limit the revenues of the producing nations of OPEC, as well as Russia and West Africa. Those nations face new challenges: Not only are the U.S. and Canada increasing output, but Iraq increasingly is realizing its potential as an oil producer, adding 600,000 barrels a day of production annually for the next several years.

"OPEC will find it challenging to survive another 60 years, let alone another decade," the report by Morse and other Citi analysts said. "But not all of the consequences are positive, for when it comes to the geopolitics of energy, the likely outcomes are asymmetric, with clear cut winner and losers."

The U.S. is a winner in many ways. Its super power status could be prolonged because of this new growth in oil and shale gas production, made possible by "fracking" and other non-conventional drilling technologies.

Crude oil generated the largest single annual increase in liquids production in U.S. history last year, with an increase of 1.16 million barrels per day. Oil production is booming in places like Texas and North Dakota, which has the lowest unemployment in the country at just 3 percent last September, compared to the national rate of 7.8 percent then.

Citi analysts also foresee a new era of U.S. industrialization, fueled by cheaper power. They cite dozens of industrial projects across America that have already begun or are planned, in such industries as auto, chemicals and steel.

The oil producing nations of OPEC, and others, will have to adjust to a world of lower prices.

Brent crude, the international benchmark, could trade in a new lower range of $70 to $90 per barrel by the end of the decade, from its recent range of $90 to $120 per barrel, Citi projects. That would be below the break-even levels required by many producing countries. The price required by Saudi Arabia is $71, and Kuwait is $44 per barrel, but many other countries have break-even levels of $110 or greater.

"This is a momentous year for what's happening, and we're having almost two million barrels a day of pipeline capacity built out in the U.S.," Morse said on "Fast Money." "The U.S. is actually going to push out about 700,000 barrels a day of light sweet crude imports this year. We think as a result of that, plus production elsewhere, we think the price is going to average, by the time you get to December, $10 less than where it is right now."

As the U.S. and Canada rise, some oil producing countries could face the threat of becoming "failed states" as their leadership grapples with greater pressure for economic and political reform while resource revenues decline, the report said. Others, especially China, could make up for some of the demand, but not all.

"Nigeria, the picture is fairly bleak. Venezuela is pretty bleak," Morse said.

As for Russia, "if it is the case that what is now a $90 Brent floor price becomes a $90 Brent ceiling price, given the dominance of hydrocarbon exports in Russian revenue, there could be a three percent hit to GDP which is by no means insignificant over the next five years, because that's how critical hydrocarbons are," he said. "Here you have a country that requires, on its own public record, $117 per barrel Urals crude, on average, to balance their budget. If the price of oil collapses to only as low as $90 a barrel, it does have that order-of-magnitude effect."

At the same time, Citi sees a big impact on the U.S. economy. The current account deficit is about 3.2 percent of GDP, and the oil import bill is 1.7 percent of GDP. Citi expects that energy self-sufficiency, combined with the impact of low natural gas prices, could cut the current account deficit by up to 2.4 percent of GDP, with an associated improvement in the dollar of 1.6 to 5.4 percent.

To realize this production boom, the energy industry's near-term challenge is moving the U.S. and Canadian oil that is locked in the heart of the continent because of insufficient pipeline transportation. Citi expects that to improve but in the meantime, the railroad industry is helping pick up the slack, shipping U.S. crude across the continent, and creating big demand for rail tanker cars.

Interdependent North America

The Citi report, titled "Energy 2020: Independence Day," also projects a larger and quicker decline in demand for oil in the U.S. over the next decade or two, due to efficiency and the shift to cheaper natural gas.

For instance, Citi expects 30 percent of the U.S. heavy duty truck fleet to turn to natural gas-based fuel by 2015, well above the 10 percent it previously forecast. That would reduce diesel demand by an estimated 600,000 barrels per day. It also expects new automotive efficiency standards to reduce U.S. oil production by two million barrels per day, up from the one million forecast last year.

"Starting this year, North American output, as we indicate in this report, should start to have tangible impacts both on global prices and trading patterns, and will eventually turn the global geopolitics of energy on its head," the report said.

Morse surprised markets a year ago with a report that envisioned the U.S. as part of an energy independent North America. Since then, the view has become mainstream. The International Energy Agency forecast last fall that the U.S. will overtake Saudi Arabia and Russia as the top oil producer by 2017. The IEA also forecast that North America could become a net oil exporter by around 2030 and the U.S. could become nearly self-sufficient by 2035.

Morse's latest report, released Tuesday, has an even more aggressive view of the U.S. move to dominance as an energy producer.

If crude oil and field condensates, natural gas liquids, renewable fuels and refinery processing gains are counted, the report put U.S. production at 11.2 million barrels per day at the end of 2012, making the U.S. the biggest oil producer already last year.

Canadian production is expected to increase to 6.5 million barrels per day, and even Mexico is now expected to join the North America energy renaissance under a new government interested in exploiting its resources.

In the past six years, oil imports into the United States have been cut in half, after peaking in 2006.

"The numbers are striking. The month of peak was 12.6 million barrels a day in October 2006 and ... now it's under six, and by late 2012 totaled 6.8 million bpd," Morse said in an interview.

Since 2006, U.S. oil field production of crude, plus natural gas liquids and bio-fuels has grown by three million barrels a day, about the same as the total output of Iran, Iraq, or Venezuela. In the same period, Canadian production has grown by 510,000 barrels a day.

"The impact of this extraordinary production growth is becoming increasingly apparent and even if the growth rate subsides in the years ahead the mushrooming impacts of this growth will have dramatic impacts," the report said. "A half decade from now combined US and Canadian output will be in surplus of projected needs. Over the next five years, demand for natural gas in the US should catch up with supply, opening up unexpected opportunities in transportation and igniting a re-industrialization of the country."

Morse, in an interview, said the U.S. could in theory need to import only from Canada within five years. "Our projection of U.S. supply growth and U.S. demand collapse is to levels where the U.S. will not need to import oil from any other country except for Canada," he said.

He expects to see a fight for market share in the U.S. and the ultimate result will be that the U.S. could re-export some Canadian crude. "But technically there should be no room for anyone else's crude," he noted.

But this does not mean the U.S. will be immune to price spikes, even with its growing supply. "Disruptions actually affect the price of oil globally and the more integrated we are in the world oil economy, the more we're going to be impacted by it. If there's a price spike, we're going to feel the price spike but the weight of our production is going to make that prices pike come from a much lower base in the future than it is now," Morse said on "Fast Money."

2013 — a year of change

U.S. oil has been landlocked in the Midwest, lacking a strong transportation system to bring supply to refining areas. A hodge podge of pipeline and rail transport has taken over, as the industry awaits further pipeline development, including the stalled Keystone pipeline.

But Citi points out that 2013 brings big change, what it calls "the most dramatic year of change ever in light sweet crude flows." Pipeline capacity in the U.S. will expand by 1.7 million barrels a day, and up to 600,000 barrels of new rail capacity will be opened between the U.S. and Canada. The report said there is an expected near doubling of receiving capacity of rail-shipped oil from 2012 to 2013.

The industry has innovated where necessary. Lacking pipelines, over half the North Dakota crude production, of 480,000 barrels a day at the end of 2012, was estimated to have been moved by rail. Much of it went to St. James, La., and Port Arthur, Texas and Mobile, Ala. Bakken is also being railed to facilities in Albany, N.Y., and New Brunswick, Canada.

The report also points out the big backlog in rail cars, many of them tank and hopper railcars. Citi said American Railcar Industries last fall said backlog for rail-cars at the end of September was 61,400, and 75 percent were tank rail-cars. Tank rail-cars transport materials like crude, chemicals, propane ethanol and asphalt.

Independent North America

The report describes how shipments of oil from West Africa have been waning and as early as this summer, West African crude shipments into the U.S. Gulf Coast could be unnecessary. East Coast refiners could also decrease dependence on West African crude, replacing more imports with midcontinent oil, brought in by rail from Pennsylvania and Virginia to upstate New York and New Jersey. That would also have a likely impact on gasoline prices, currently at record highs for this time of year because of refining issues.

There is also pressure to move light sweet crude from the Gulf Coast to higher value locations. For instance, Morse expects to see light sweet crude move form the U.S. Gulf Coast to eastern Canada, displacing more West African imports to North America.

Citi expects that within two years, there could be pressure for more exports to other destinations or for pipelines on the East Coast or to change laws that would allow shipping of crude from the Gulf Coast to the East Coast by non-U.S. flagged ships.

By the end of 2014, Citi expects that sour Canadian crude should make its way to the Gulf Coast by way of new pipelines and that should provide a challenge for other producers shipping to the Gulf Coast, including Saudi Arabia, Iraq, Kuwait , Venezuela and Mexico. Morse says they could be pushed out by Canadian crude, or these producers could preserve market share by cutting prices.

Canadian and U.S. crude should be delivered in greater quantities to the U.S. East Coast and Gulf Coast by mid-decade. A happenstance of poor transportation for all this energy wealth leaves Canadian crude locked in North America, but with exporting ability through the U.S. Gulf Coast until pipelines are approved and built in Canada. Morse said if that were to happen, Canada could see an export boom to the Pacific basin, turning Canadian crude into the benchmark for that region.

The report notes that even before Canada builds pipelines to the Pacific: "There should be exports of crude from the U.S. Gulf Coast -- Canadian crude for sure and potentially U.S. crude if the U.S. succumbs to economic logic and lifts current multiple bans on exports," the report said.

Asked how his report has been received so far, Morse said, with an ironic laugh, that he's had some "push back but not as much as last year."

http://www.nbcnews.com/business/economy ... -1C8344034

Patti Domm , CNBC.com

US is on fast-track to energy independence, report suggests

U.S. oil and gas production is evolving so rapidly — and demand is dropping so quickly — that in just five years the U.S. could no longer need to buy oil from any source but Canada, according to Citigroup's global head of commodities research.

Citigroup's Edward Morse, in a new report, projects a dramatic reshaping of the global energy industry, where the U.S., in a matter of years, becomes an exporter of energy, instead of one of the biggest importers.

The shift could sharply reduce the price of oil, and therefore limit the revenues of the producing nations of OPEC, as well as Russia and West Africa. Those nations face new challenges: Not only are the U.S. and Canada increasing output, but Iraq increasingly is realizing its potential as an oil producer, adding 600,000 barrels a day of production annually for the next several years.

"OPEC will find it challenging to survive another 60 years, let alone another decade," the report by Morse and other Citi analysts said. "But not all of the consequences are positive, for when it comes to the geopolitics of energy, the likely outcomes are asymmetric, with clear cut winner and losers."

The U.S. is a winner in many ways. Its super power status could be prolonged because of this new growth in oil and shale gas production, made possible by "fracking" and other non-conventional drilling technologies.

Crude oil generated the largest single annual increase in liquids production in U.S. history last year, with an increase of 1.16 million barrels per day. Oil production is booming in places like Texas and North Dakota, which has the lowest unemployment in the country at just 3 percent last September, compared to the national rate of 7.8 percent then.

Citi analysts also foresee a new era of U.S. industrialization, fueled by cheaper power. They cite dozens of industrial projects across America that have already begun or are planned, in such industries as auto, chemicals and steel.

The oil producing nations of OPEC, and others, will have to adjust to a world of lower prices.

Brent crude, the international benchmark, could trade in a new lower range of $70 to $90 per barrel by the end of the decade, from its recent range of $90 to $120 per barrel, Citi projects. That would be below the break-even levels required by many producing countries. The price required by Saudi Arabia is $71, and Kuwait is $44 per barrel, but many other countries have break-even levels of $110 or greater.

"This is a momentous year for what's happening, and we're having almost two million barrels a day of pipeline capacity built out in the U.S.," Morse said on "Fast Money." "The U.S. is actually going to push out about 700,000 barrels a day of light sweet crude imports this year. We think as a result of that, plus production elsewhere, we think the price is going to average, by the time you get to December, $10 less than where it is right now."

As the U.S. and Canada rise, some oil producing countries could face the threat of becoming "failed states" as their leadership grapples with greater pressure for economic and political reform while resource revenues decline, the report said. Others, especially China, could make up for some of the demand, but not all.

"Nigeria, the picture is fairly bleak. Venezuela is pretty bleak," Morse said.

As for Russia, "if it is the case that what is now a $90 Brent floor price becomes a $90 Brent ceiling price, given the dominance of hydrocarbon exports in Russian revenue, there could be a three percent hit to GDP which is by no means insignificant over the next five years, because that's how critical hydrocarbons are," he said. "Here you have a country that requires, on its own public record, $117 per barrel Urals crude, on average, to balance their budget. If the price of oil collapses to only as low as $90 a barrel, it does have that order-of-magnitude effect."

At the same time, Citi sees a big impact on the U.S. economy. The current account deficit is about 3.2 percent of GDP, and the oil import bill is 1.7 percent of GDP. Citi expects that energy self-sufficiency, combined with the impact of low natural gas prices, could cut the current account deficit by up to 2.4 percent of GDP, with an associated improvement in the dollar of 1.6 to 5.4 percent.

To realize this production boom, the energy industry's near-term challenge is moving the U.S. and Canadian oil that is locked in the heart of the continent because of insufficient pipeline transportation. Citi expects that to improve but in the meantime, the railroad industry is helping pick up the slack, shipping U.S. crude across the continent, and creating big demand for rail tanker cars.

Interdependent North America

The Citi report, titled "Energy 2020: Independence Day," also projects a larger and quicker decline in demand for oil in the U.S. over the next decade or two, due to efficiency and the shift to cheaper natural gas.

For instance, Citi expects 30 percent of the U.S. heavy duty truck fleet to turn to natural gas-based fuel by 2015, well above the 10 percent it previously forecast. That would reduce diesel demand by an estimated 600,000 barrels per day. It also expects new automotive efficiency standards to reduce U.S. oil production by two million barrels per day, up from the one million forecast last year.

"Starting this year, North American output, as we indicate in this report, should start to have tangible impacts both on global prices and trading patterns, and will eventually turn the global geopolitics of energy on its head," the report said.

Morse surprised markets a year ago with a report that envisioned the U.S. as part of an energy independent North America. Since then, the view has become mainstream. The International Energy Agency forecast last fall that the U.S. will overtake Saudi Arabia and Russia as the top oil producer by 2017. The IEA also forecast that North America could become a net oil exporter by around 2030 and the U.S. could become nearly self-sufficient by 2035.

Morse's latest report, released Tuesday, has an even more aggressive view of the U.S. move to dominance as an energy producer.

If crude oil and field condensates, natural gas liquids, renewable fuels and refinery processing gains are counted, the report put U.S. production at 11.2 million barrels per day at the end of 2012, making the U.S. the biggest oil producer already last year.

Canadian production is expected to increase to 6.5 million barrels per day, and even Mexico is now expected to join the North America energy renaissance under a new government interested in exploiting its resources.

In the past six years, oil imports into the United States have been cut in half, after peaking in 2006.

"The numbers are striking. The month of peak was 12.6 million barrels a day in October 2006 and ... now it's under six, and by late 2012 totaled 6.8 million bpd," Morse said in an interview.

Since 2006, U.S. oil field production of crude, plus natural gas liquids and bio-fuels has grown by three million barrels a day, about the same as the total output of Iran, Iraq, or Venezuela. In the same period, Canadian production has grown by 510,000 barrels a day.

"The impact of this extraordinary production growth is becoming increasingly apparent and even if the growth rate subsides in the years ahead the mushrooming impacts of this growth will have dramatic impacts," the report said. "A half decade from now combined US and Canadian output will be in surplus of projected needs. Over the next five years, demand for natural gas in the US should catch up with supply, opening up unexpected opportunities in transportation and igniting a re-industrialization of the country."

Morse, in an interview, said the U.S. could in theory need to import only from Canada within five years. "Our projection of U.S. supply growth and U.S. demand collapse is to levels where the U.S. will not need to import oil from any other country except for Canada," he said.

He expects to see a fight for market share in the U.S. and the ultimate result will be that the U.S. could re-export some Canadian crude. "But technically there should be no room for anyone else's crude," he noted.

But this does not mean the U.S. will be immune to price spikes, even with its growing supply. "Disruptions actually affect the price of oil globally and the more integrated we are in the world oil economy, the more we're going to be impacted by it. If there's a price spike, we're going to feel the price spike but the weight of our production is going to make that prices pike come from a much lower base in the future than it is now," Morse said on "Fast Money."

2013 — a year of change

U.S. oil has been landlocked in the Midwest, lacking a strong transportation system to bring supply to refining areas. A hodge podge of pipeline and rail transport has taken over, as the industry awaits further pipeline development, including the stalled Keystone pipeline.

But Citi points out that 2013 brings big change, what it calls "the most dramatic year of change ever in light sweet crude flows." Pipeline capacity in the U.S. will expand by 1.7 million barrels a day, and up to 600,000 barrels of new rail capacity will be opened between the U.S. and Canada. The report said there is an expected near doubling of receiving capacity of rail-shipped oil from 2012 to 2013.

The industry has innovated where necessary. Lacking pipelines, over half the North Dakota crude production, of 480,000 barrels a day at the end of 2012, was estimated to have been moved by rail. Much of it went to St. James, La., and Port Arthur, Texas and Mobile, Ala. Bakken is also being railed to facilities in Albany, N.Y., and New Brunswick, Canada.

The report also points out the big backlog in rail cars, many of them tank and hopper railcars. Citi said American Railcar Industries last fall said backlog for rail-cars at the end of September was 61,400, and 75 percent were tank rail-cars. Tank rail-cars transport materials like crude, chemicals, propane ethanol and asphalt.

Independent North America

The report describes how shipments of oil from West Africa have been waning and as early as this summer, West African crude shipments into the U.S. Gulf Coast could be unnecessary. East Coast refiners could also decrease dependence on West African crude, replacing more imports with midcontinent oil, brought in by rail from Pennsylvania and Virginia to upstate New York and New Jersey. That would also have a likely impact on gasoline prices, currently at record highs for this time of year because of refining issues.

There is also pressure to move light sweet crude from the Gulf Coast to higher value locations. For instance, Morse expects to see light sweet crude move form the U.S. Gulf Coast to eastern Canada, displacing more West African imports to North America.

Citi expects that within two years, there could be pressure for more exports to other destinations or for pipelines on the East Coast or to change laws that would allow shipping of crude from the Gulf Coast to the East Coast by non-U.S. flagged ships.

By the end of 2014, Citi expects that sour Canadian crude should make its way to the Gulf Coast by way of new pipelines and that should provide a challenge for other producers shipping to the Gulf Coast, including Saudi Arabia, Iraq, Kuwait , Venezuela and Mexico. Morse says they could be pushed out by Canadian crude, or these producers could preserve market share by cutting prices.

Canadian and U.S. crude should be delivered in greater quantities to the U.S. East Coast and Gulf Coast by mid-decade. A happenstance of poor transportation for all this energy wealth leaves Canadian crude locked in North America, but with exporting ability through the U.S. Gulf Coast until pipelines are approved and built in Canada. Morse said if that were to happen, Canada could see an export boom to the Pacific basin, turning Canadian crude into the benchmark for that region.

The report notes that even before Canada builds pipelines to the Pacific: "There should be exports of crude from the U.S. Gulf Coast -- Canadian crude for sure and potentially U.S. crude if the U.S. succumbs to economic logic and lifts current multiple bans on exports," the report said.

Asked how his report has been received so far, Morse said, with an ironic laugh, that he's had some "push back but not as much as last year."

-

Kentucky Trojan

- SE

- Posts: 2183

- Joined: Sat Jul 10, 2010 4:52 pm

Re: Deficit = not a problem

I will believe the energy independence when I see it.

Right now...gas is $3.69 a gallon.

Right now...gas is $3.69 a gallon.

- dazed&confused

- SEOPS HO

- Posts: 9287

- Joined: Thu Jul 17, 2008 11:39 am

- Location: Those who do not remember the past are doomed to repeat it

Re: Deficit = not a problem

Kentucky Trojan wrote:I will believe the energy independence when I see it.

Right now...gas is $3.69 a gallon.

-

Kentucky Trojan

- SE

- Posts: 2183

- Joined: Sat Jul 10, 2010 4:52 pm

Re: Deficit = not a problem

How has your master been lately, dazed&confused?

We haven't heard from him lately.

We haven't heard from him lately.

- dazed&confused

- SEOPS HO

- Posts: 9287

- Joined: Thu Jul 17, 2008 11:39 am

- Location: Those who do not remember the past are doomed to repeat it

Re: Deficit = not a problem

I have no Master but I do admire one particular man.Kentucky Trojan wrote:How has your master been lately, dazed&confused?

We haven't heard from him lately.

He's been dead since 1972 and he still makes more sense than your puppets!

-

Kentucky Trojan

- SE

- Posts: 2183

- Joined: Sat Jul 10, 2010 4:52 pm

Re: Deficit = not a problem

I am a Truman fan as well.dazed&confused wrote:I have no Master but I do admire one particular man.Kentucky Trojan wrote:How has your master been lately, dazed&confused?

We haven't heard from him lately.

He's been dead since 1972 and he still makes more sense than your puppets!

This is one thing that we have in common.

Truman acted more like today's Republican than today's Democrat.

- dazed&confused

- SEOPS HO

- Posts: 9287

- Joined: Thu Jul 17, 2008 11:39 am

- Location: Those who do not remember the past are doomed to repeat it

Re: Deficit = not a problem

Truman believed government was a necessary and positive influence on the lives of everyday Americans. He believed power and wealth concentrated in too few special interests were bad for the country. He believed the average American was worth more than the the greatest Wall Street banker. He believed in universal health care. He pushed for civil rights when it nearly cost him his Presidency. He hated military generals mostly as they were prima donnas and McArthur threatened civilian control of the military. He thought the office of the Presidency deserved respect no matter who held the office. He fought the irrational hatred of McCarthy and the destruction it brought to innocent people. And he always had the humility to believe thousands of men were more qualified to be President than he but he was the one who was called to serve the people. We could use more of that in Washington today!

-

Kentucky Trojan

- SE

- Posts: 2183

- Joined: Sat Jul 10, 2010 4:52 pm

Re: Deficit = not a problem

This does not sound like Obama.....dazed&confused wrote:Truman believed government was a necessary and positive influence on the lives of everyday Americans. He believed power and wealth concentrated in too few special interests were bad for the country. He believed the average American was worth more than the the greatest Wall Street banker. He believed in universal health care. He pushed for civil rights when it nearly cost him his Presidency. He hated military generals mostly as they were prima donnas and McArthur threatened civilian control of the military. He thought the office of the Presidency deserved respect no matter who held the office. He fought the irrational hatred of McCarthy and the destruction it brought to innocent people. And he always had the humility to believe thousands of men were more qualified to be President than he but he was the one who was called to serve the people. We could use more of that in Washington today!

- dazed&confused

- SEOPS HO

- Posts: 9287

- Joined: Thu Jul 17, 2008 11:39 am

- Location: Those who do not remember the past are doomed to repeat it

Re: Deficit = not a problem

It sure as hell doesn't sound like a Repubican!Kentucky Trojan wrote:This does not sound like Obama.....dazed&confused wrote:Truman believed government was a necessary and positive influence on the lives of everyday Americans. He believed power and wealth concentrated in too few special interests were bad for the country. He believed the average American was worth more than the the greatest Wall Street banker. He believed in universal health care. He pushed for civil rights when it nearly cost him his Presidency. He hated military generals mostly as they were prima donnas and McArthur threatened civilian control of the military. He thought the office of the Presidency deserved respect no matter who held the office. He fought the irrational hatred of McCarthy and the destruction it brought to innocent people. And he always had the humility to believe thousands of men were more qualified to be President than he but he was the one who was called to serve the people. We could use more of that in Washington today!

-

Kentucky Trojan

- SE

- Posts: 2183

- Joined: Sat Jul 10, 2010 4:52 pm

Re: Deficit = not a problem

Thanks for confirming that Truman was far superior to Obama as a President...dazed&confused wrote:It sure as hell doesn't sound like a Repubican!Kentucky Trojan wrote:This does not sound like Obama.....dazed&confused wrote:Truman believed government was a necessary and positive influence on the lives of everyday Americans. He believed power and wealth concentrated in too few special interests were bad for the country. He believed the average American was worth more than the the greatest Wall Street banker. He believed in universal health care. He pushed for civil rights when it nearly cost him his Presidency. He hated military generals mostly as they were prima donnas and McArthur threatened civilian control of the military. He thought the office of the Presidency deserved respect no matter who held the office. He fought the irrational hatred of McCarthy and the destruction it brought to innocent people. And he always had the humility to believe thousands of men were more qualified to be President than he but he was the one who was called to serve the people. We could use more of that in Washington today!

- dazed&confused

- SEOPS HO

- Posts: 9287

- Joined: Thu Jul 17, 2008 11:39 am

- Location: Those who do not remember the past are doomed to repeat it

Re: Deficit = not a problem

Truman would have given up everything he accomplished if he could have achieved universal health care. So, what's your point here?

-

Kentucky Trojan

- SE

- Posts: 2183

- Joined: Sat Jul 10, 2010 4:52 pm

Re: Deficit = not a problem

...not at the sake of having it cost more......dazed&confused wrote:Truman would have given up everything he accomplished if he could have achieved universal health care. So, what's your point here?

...he was a deficit hawk before his time.....

- dazed&confused

- SEOPS HO

- Posts: 9287

- Joined: Thu Jul 17, 2008 11:39 am

- Location: Those who do not remember the past are doomed to repeat it

Re: Deficit = not a problem

Kentucky Trojan wrote:...not at the sake of having it cost more......dazed&confused wrote:Truman would have given up everything he accomplished if he could have achieved universal health care. So, what's your point here?

...he was a deficit hawk before his time.....

President Lyndon B. Johnson's

Remarks With President Truman at the Signing in

Independence of the Medicare Bill

July 30, 1965

PRESIDENT TRUMAN. Thank you very much. I am glad you like the President. I like him too. He is one of the finest men I ever ran across.

Mr. President, Mrs. Johnson, distinguished guests:

You have done me a great honor in coming here today, and you have made me a very, very happy man.

This is an important hour for the Nation, for those of our citizens who have completed their tour of duty and have moved to the sidelines. These are the days that we are trying to celebrate for them. These people are our prideful responsibility and they are entitled, among other benefits, to the best medical protection available.

Not one of these, our citizens, should ever be abandoned to the indignity of charity. Charity is indignity when you have to have it. But we don't want these people to have anything to do with charity and we don't want them to have any idea of hopeless despair.

Mr. President, I am glad to have lived this long and to witness today the signing of the Medicare bill which puts this Nation right where it needs to be, to be right. Your inspired leadership and a responsive forward-looking Congress have made it historically possible for this day to come about.

-

Kentucky Trojan

- SE

- Posts: 2183

- Joined: Sat Jul 10, 2010 4:52 pm

Re: Deficit = not a problem

....awesome for 47 years ago...costs were stagnant then...dazed&confused wrote:Kentucky Trojan wrote:...not at the sake of having it cost more......dazed&confused wrote:Truman would have given up everything he accomplished if he could have achieved universal health care. So, what's your point here?

...he was a deficit hawk before his time.....

President Lyndon B. Johnson's

Remarks With President Truman at the Signing in

Independence of the Medicare Bill

July 30, 1965

PRESIDENT TRUMAN. Thank you very much. I am glad you like the President. I like him too. He is one of the finest men I ever ran across.

Mr. President, Mrs. Johnson, distinguished guests:

You have done me a great honor in coming here today, and you have made me a very, very happy man.

This is an important hour for the Nation, for those of our citizens who have completed their tour of duty and have moved to the sidelines. These are the days that we are trying to celebrate for them. These people are our prideful responsibility and they are entitled, among other benefits, to the best medical protection available.

Not one of these, our citizens, should ever be abandoned to the indignity of charity. Charity is indignity when you have to have it. But we don't want these people to have anything to do with charity and we don't want them to have any idea of hopeless despair.

Mr. President, I am glad to have lived this long and to witness today the signing of the Medicare bill which puts this Nation right where it needs to be, to be right. Your inspired leadership and a responsive forward-looking Congress have made it historically possible for this day to come about.

...Universal Health Care in today's age will increase costs dramatically...

...no can do...

-

Kentucky Trojan

- SE

- Posts: 2183

- Joined: Sat Jul 10, 2010 4:52 pm